Sharevest

Sharevest Review

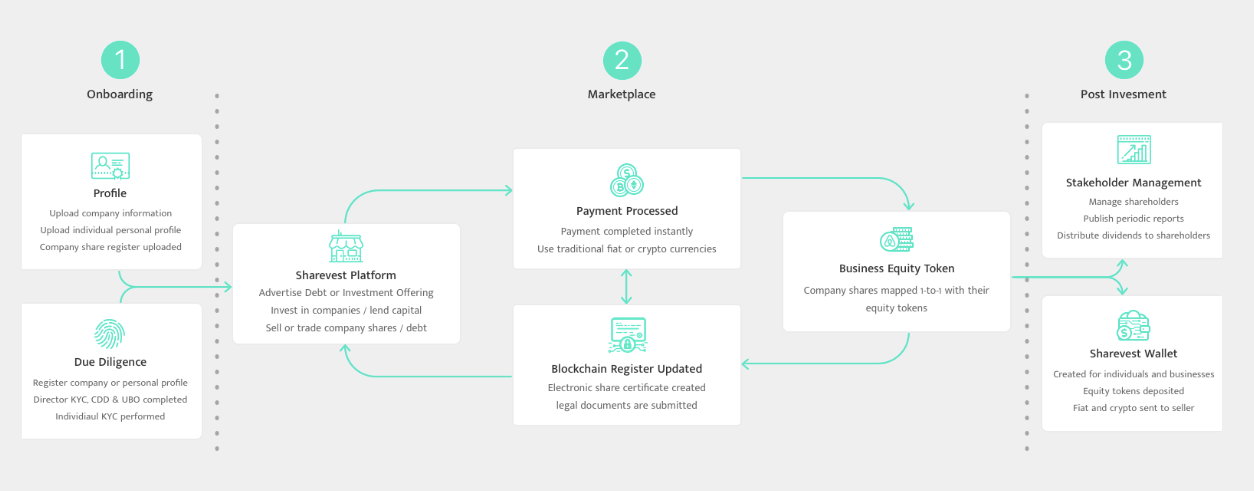

The Sharevest platform sets itself the traditional forms of attracting capital. We unite enterprises that are underfunded due to the fact that banks are retreating from lending and linking them with a bank of global investors. Sharevest is built on a secure distributed registration platform that allows you to use global investment listings and instant transfer of ownership of shares using electronic certificates.

Our platform is an asset market specifically designed to facilitate private equity investments on a global scale in the primary and secondary markets. Sharevest partners startups, small and medium enterprises (SMEs), as well as growing companies with viable investors with several advantages for both sides. We strive to use the opportunities of social networks and integrate them into the platform of Sharevest to create a dynamic social trading network. Users will be able to follow the interests of investors or track companies. This function brings a new and exciting function to traditional investments for both companies and investors.

Companies can manage investment rounds, having access to investors around the world in one place. Meanwhile, investors can open, track and invest in enterprises of interest, access to the global registrar of the company, Sharevest. The platform also provides both parties with the appropriate tools to promote the most productive lines of communication and transparency.

How does Sharevest work?

What is Sharevest?

Our platform allows growing companies to manage several investment rounds, while investors can open and invest in business. The blocking of Sharevest means that we can carry out the transfer of shares in real time and automate the processing of fully compatible documents. Our shares with shares and electronic certificates of shares make the transfer of shares between the two parties, fast, transparent and trustful.

Our Blockchain Technologies

Our digital assets platform maximizes the blockage to replace complex intermediaries that dominate the securities market. View the general registry, shareholder management, reporting and more can be done in real time due to our tokenized system. In fact, the digitization of stock registers allows companies to capitalize their non-listed shares and the management potential of stakeholders.

Why do you need Sharevest?

Our goal in Sharevest is to develop a financial ecosystem that will support companies at all stages of their life cycle. We have combined symbolic justice and a system of electronic share certificates, which will simplify the transfer of shares. Our primary and secondary markets are interchangeable, which will reduce legal documentation and costs when attracting capital.

Tokens

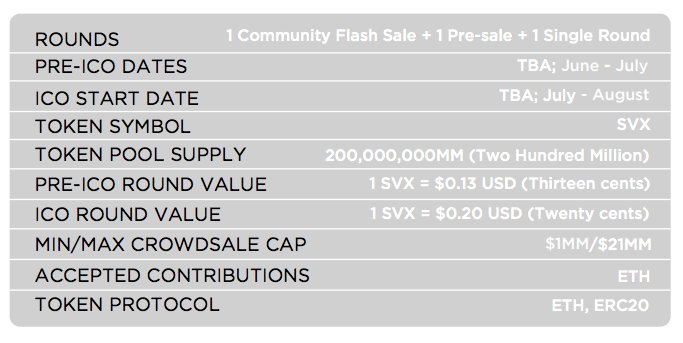

In the pre-sale round, the target price per unit was $ 0.24 (twenty-four cents) per token with a 10% token pool allocation. The price of the token on the ICO will increase by 60%, and will be $ 0.36 (thirty-six cents) per unit. As for the remaining 21%: 20% are distributed to the company's shareholders and early investors; 10% is allocated to the team members; 5% of the allocations for the referral scheme of the Sharevest platform community, 3% for the Bounty and 2% for legal and consulting expenses.

Distribution of tokens

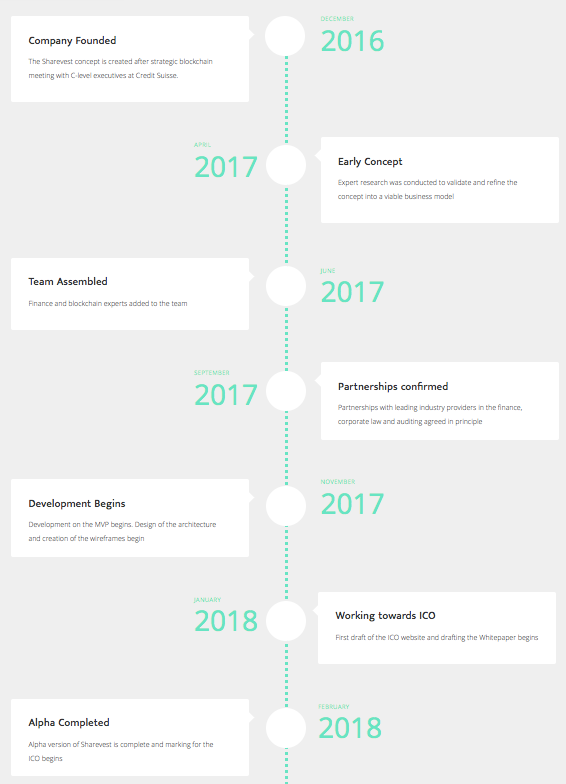

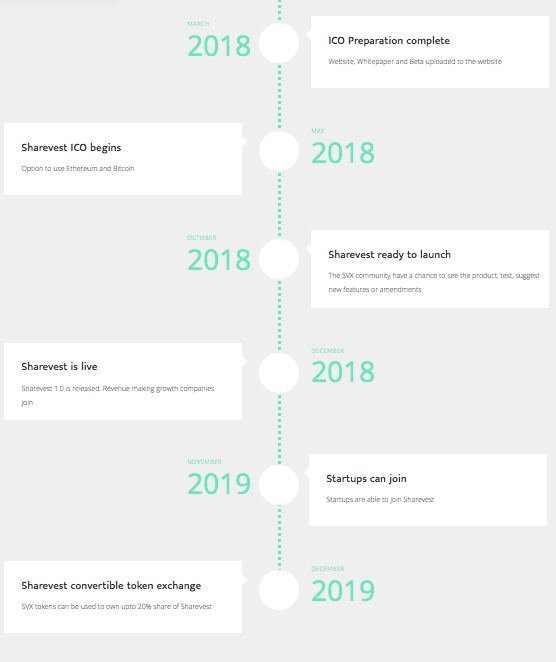

Roadmap

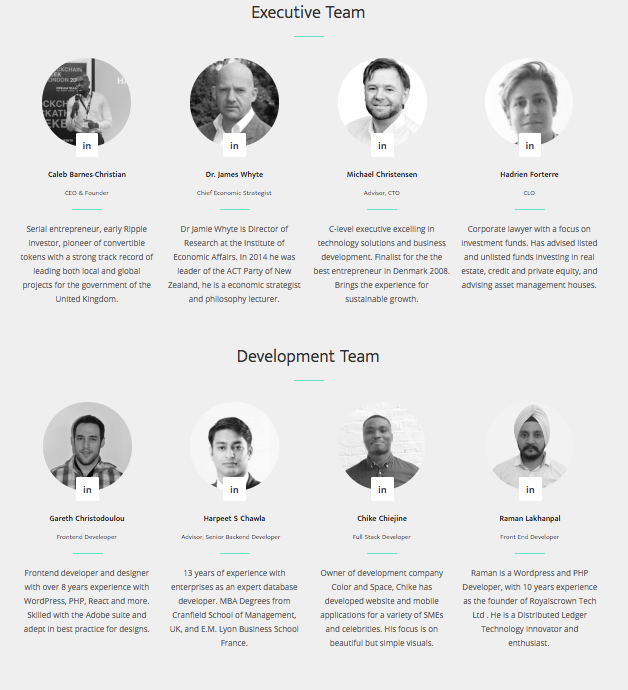

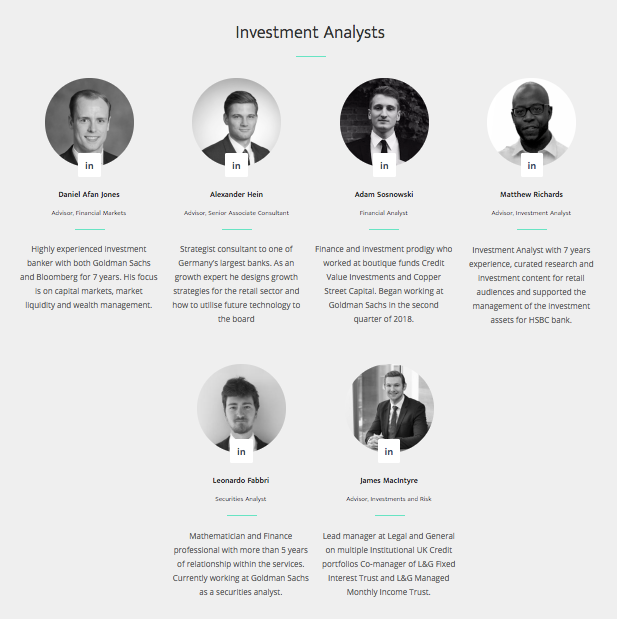

The project team

To contribute and know about the progress of this campaign, you can visit some of the following links:

WEBSITE: https://sharevest.co/

WHITE PAPER: https://sharevest.co/whitepaper.pdf

TELEGRAM: https://telegram.me/sharevestX

FACEBOOK: https://www.facebook.com/sharevestx/

TWITTER: https://twitter.com/sharevestX

MEDIUM: https://medium.com/@sharevestX

AUTHOR: Beroto yudo

bitcointalk profil: https://bitcointalk.org/index.php?action=profile;u=1836807

ETH addres: 0xB9f8f25499A7670A562750258509612b650005c9

Komentar

Posting Komentar